Appearance

使用示例

量价因子 范例 1

python

from rqfactor import *

from rqfactor.extension import *

from rqfactor.engine_v2 import *

import rqdatac

rqdatac.init()

VWAP = Factor('total_turnover') / Factor('volume')

f = (RANK((VWAP - Factor('close'))) / RANK((VWAP + Factor('close'))))量价因子 范例 2

python

from rqfactor import *

from rqfactor.extension import *

from rqfactor.engine_v2 import *

import rqdatac

import numpy as np

import pandas as pd

rqdatac.init()

#定义自定义因子

def buy_volume(order_book_ids,start_date,end_date):

return rqdatac.get_capital_flow(order_book_ids,start_date,end_date).buy_volume.unstack('order_book_id').reindex(columns=order_book_ids,index =pd.to_datetime(rqdatac.get_trading_dates(start_date,end_date)))

def sell_volume(order_book_ids,start_date,end_date):

return rqdatac.get_capital_flow(order_book_ids,start_date,end_date).sell_volume.unstack('order_book_id').reindex(columns=order_book_ids,index =pd.to_datetime(rqdatac.get_trading_dates(start_date,end_date)))

BUY_VOLUME = UserDefinedLeafFactor('BUY_VOLUME',buy_volume)

SELL_VOLUME = UserDefinedLeafFactor('SELL_VOLUME',sell_volume)

f = DELTA(MA(BUY_VOLUME-SELL_VOLUME,13)/IF(MA(ABS(BUY_VOLUME-SELL_VOLUME),13) !=0,MA(ABS(BUY_VOLUME-SELL_VOLUME),13),np.nan),3)

d1='20190101'

d2='20200101'

df = execute_factor(f,rqdatac.index_components('000300.XSHG', d1),d1,d2)

#实例化引擎

engine=FactorAnalysisEngine()

#构建管道,对因子进行预处理

engine.append(('neutralization', Neutralization(industry='citics_2019', style_factors=['size','beta','earnings_yield','growth','liquidity','leverage','book_to_price','residual_volatility','non_linear_size'])))

#构建管道,添加因子分析器

engine.append(('rank_ic_analysis', ICAnalysis(rank_ic=True, industry_classification='sws',max_decay=20)))

engine.append(('quantile', QuantileReturnAnalysis(quantile=5, benchmark=None)))

engine.append(('return',FactorReturnAnalysis()))

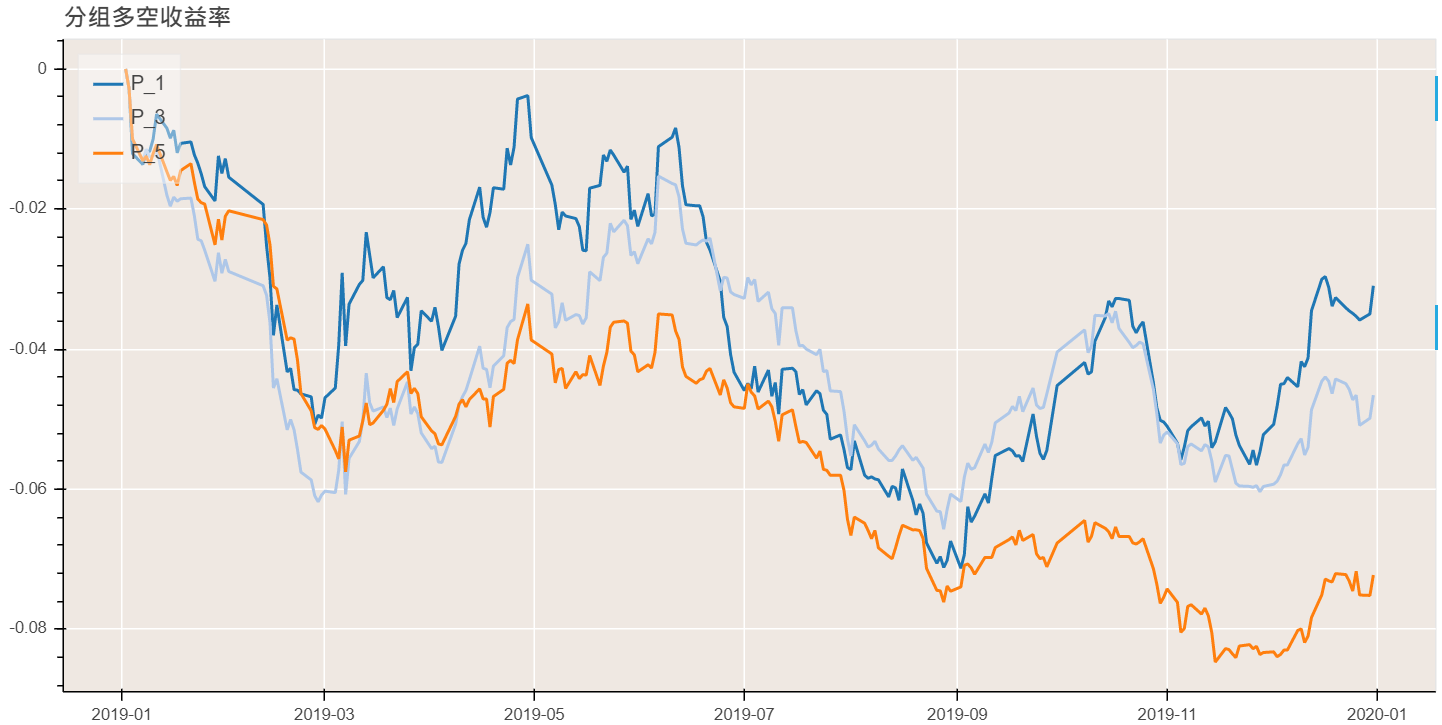

#调仓周期为1,3,5

result = engine.analysis(df, 'daily', ascending=True, periods=[1,3,5], keep_preprocess_result=True)- 查看因子 IC 分析结果

python

In[]:

result['rank_ic_analysis'].summary()

Out[]:

P_1 P_3 P_5

mean 0.002531 -0.005552 -0.012799

std 0.062977 0.064005 0.060862

positive 117.000000 118.000000 107.000000

negative 127.000000 126.000000 137.000000

significance 0.024590 0.040984 0.036885

sig_positive 0.012295 0.004098 0.008197

sig_negative 0.008197 0.024590 0.008197

t_stat 0.627707 -1.354970 -3.284878

p_value 0.530785 0.176685 0.001171

skew 0.223259 -0.401776 -0.088231

kurtosis 0.176964 0.414680 -0.099484

ir 0.040185 -0.086743 -0.210293- 绘制因子分组收益率结果

python

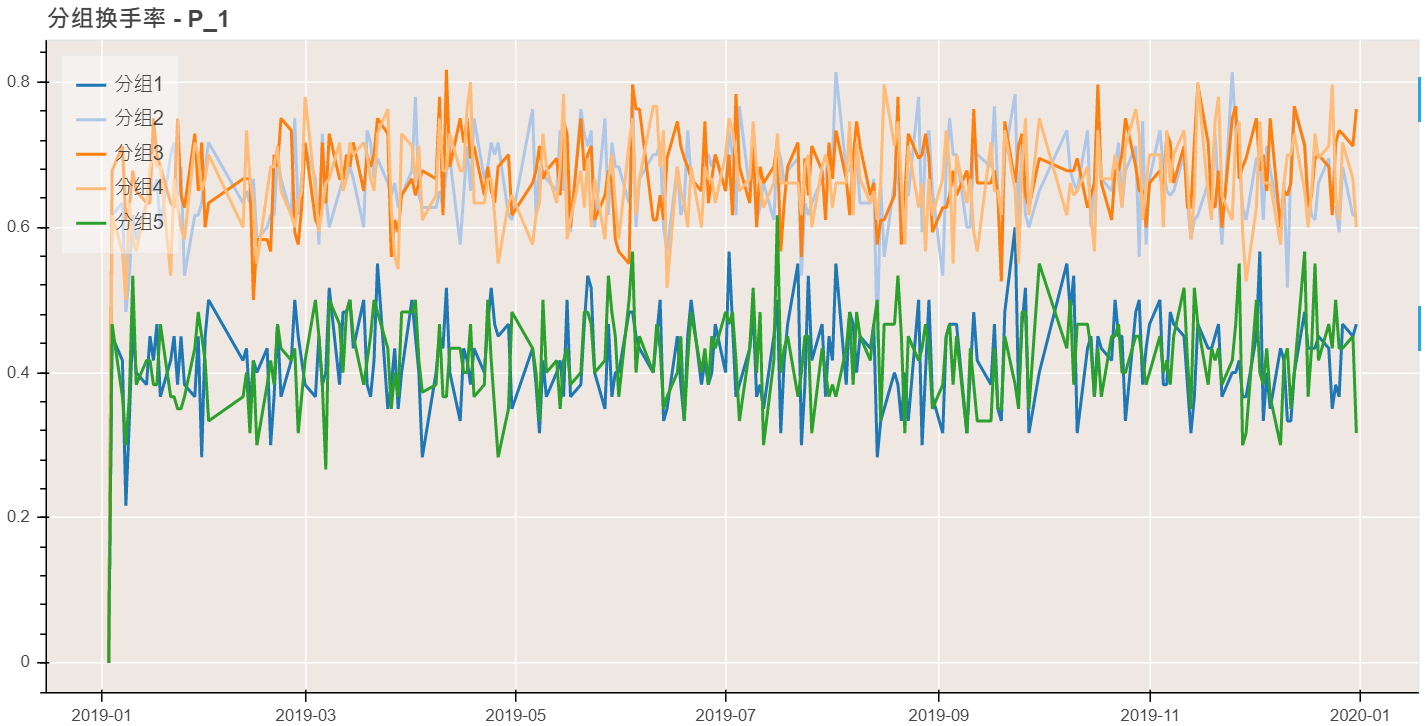

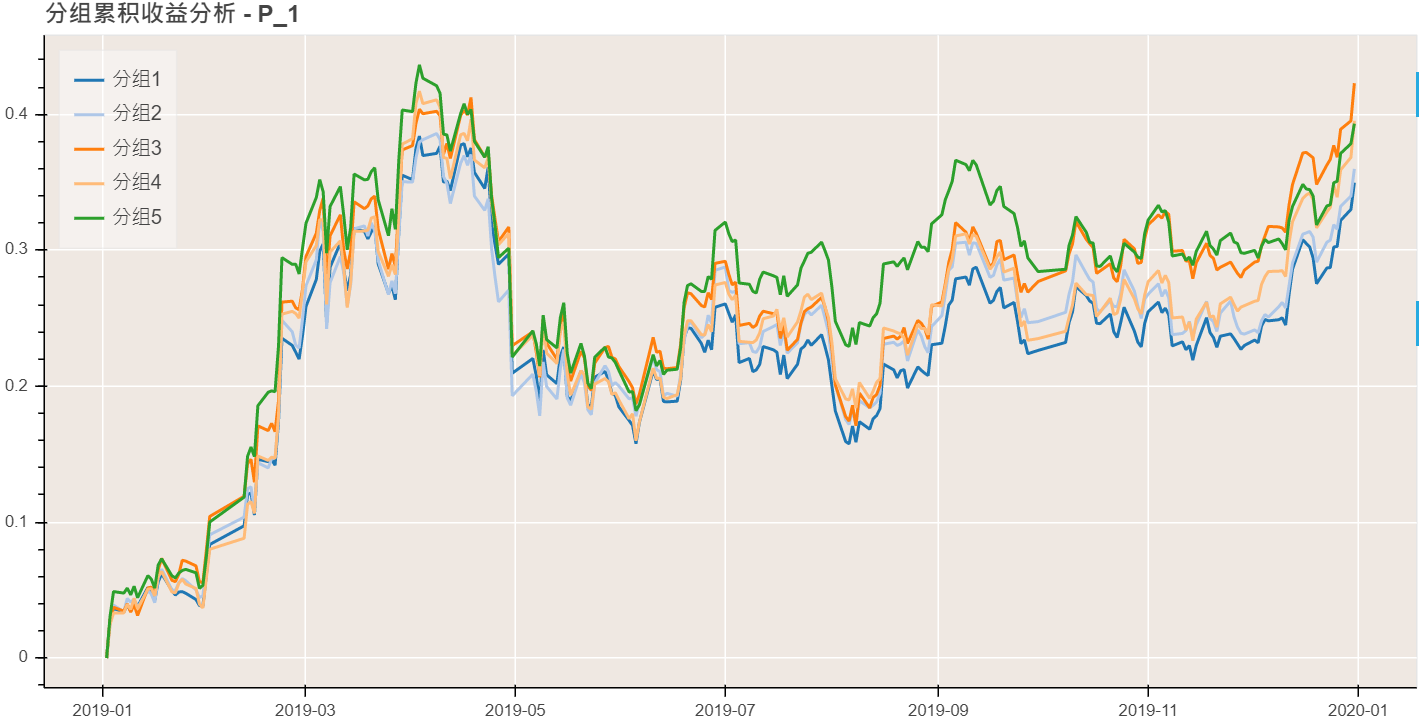

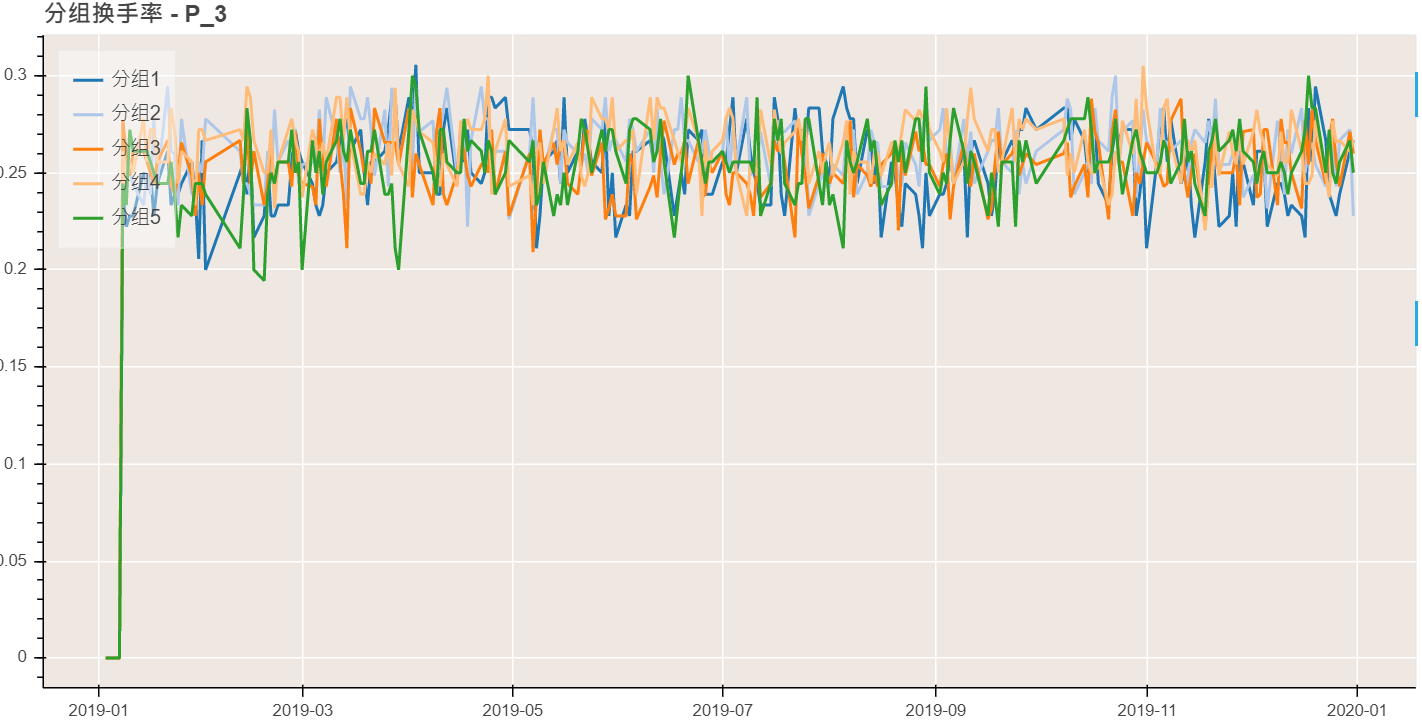

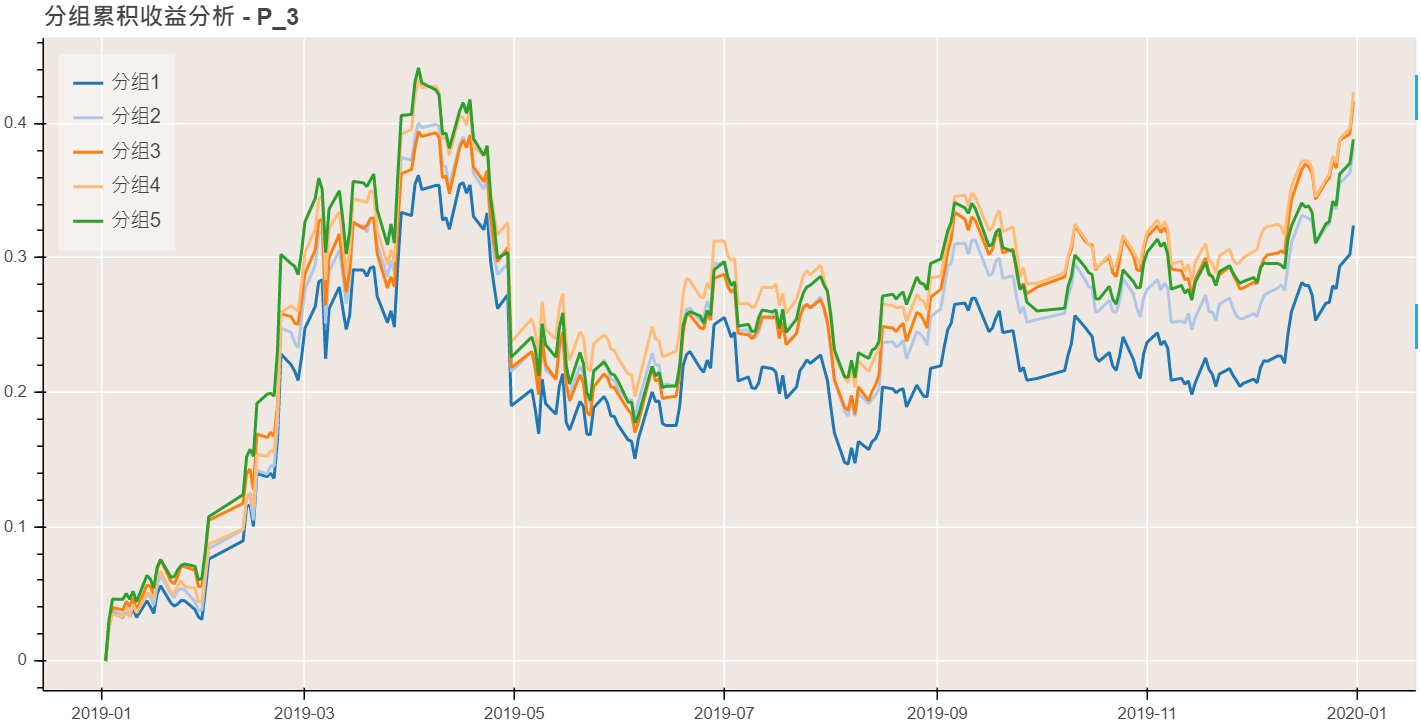

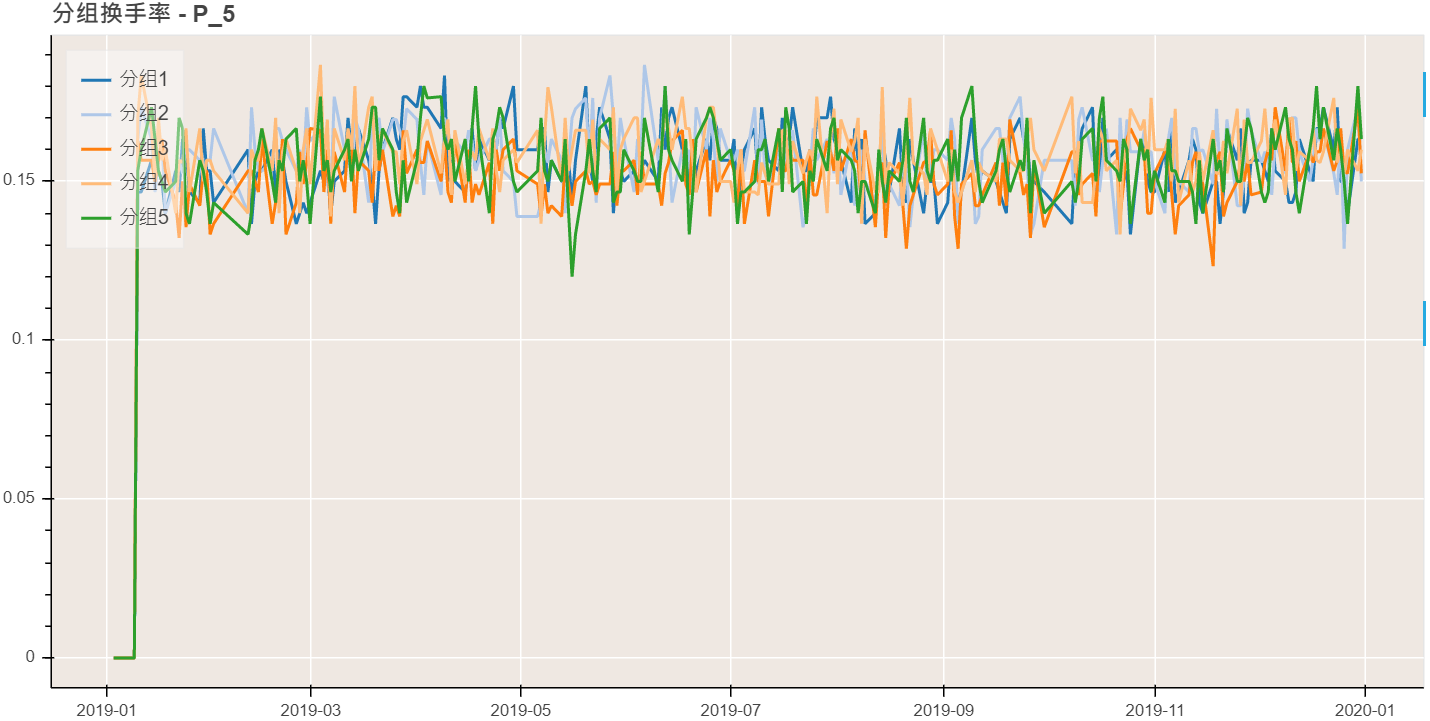

result['quantile'].show()

- 绘制因子收益率结果

python

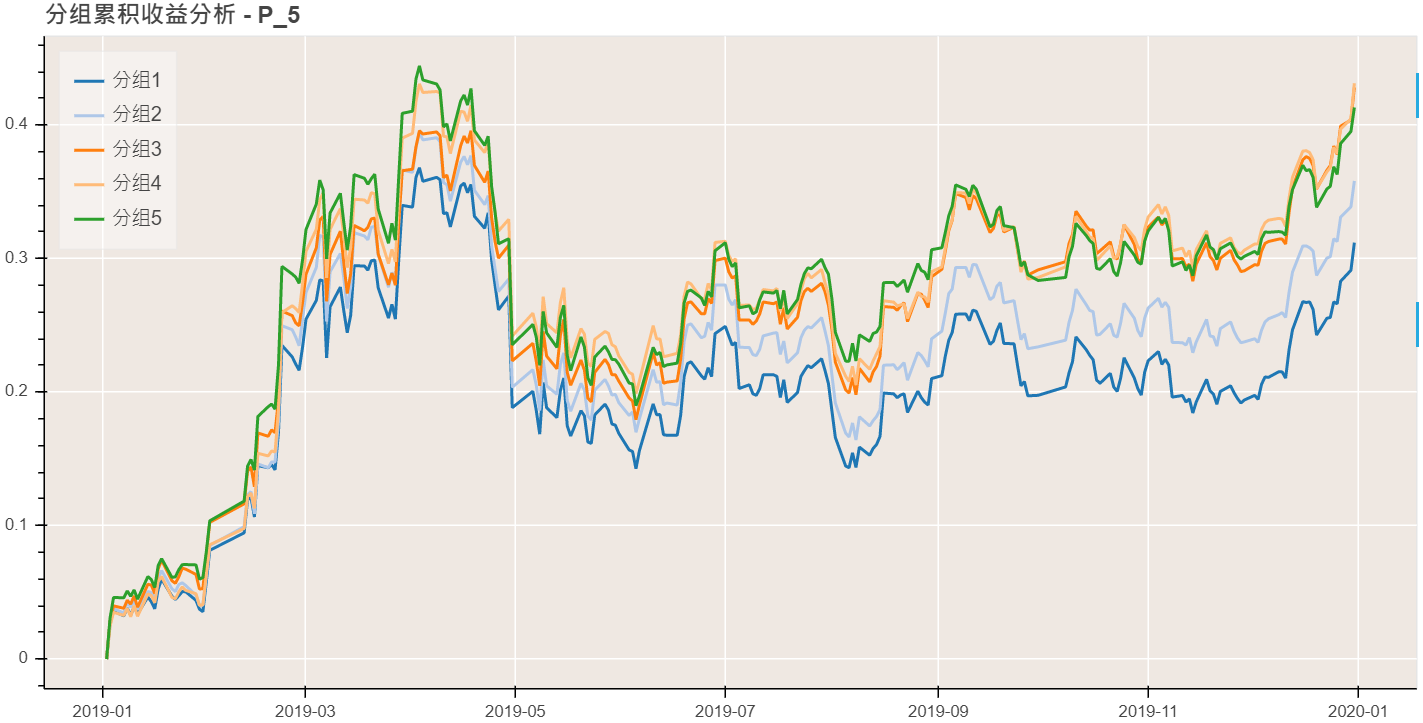

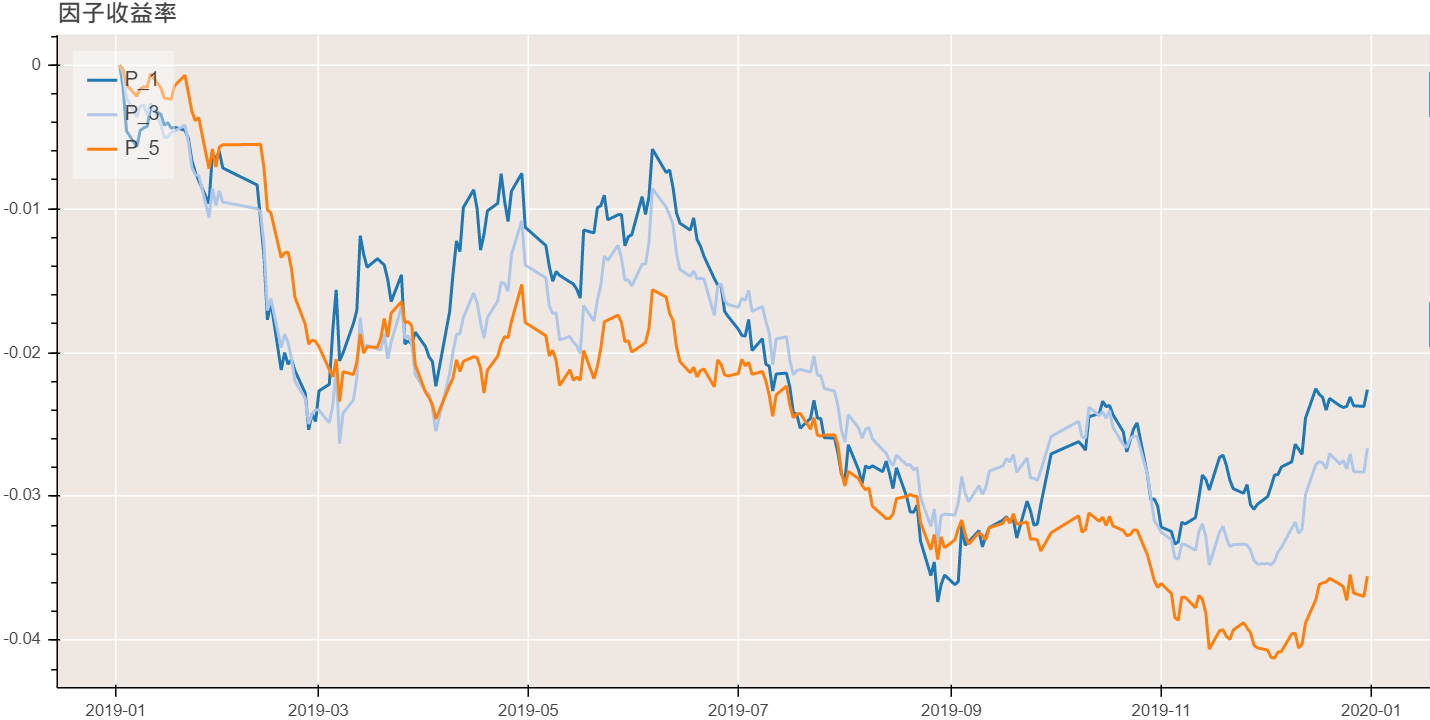

result['return'].show()

月度因子(自然月)范例

财务因子比较偏向价值投资,一般持有期会相对较长,这里采用以自然月为收益区间验证财务因子

python

from rqfactor import *

from rqdatac import *

import pandas as pd

init()

#因子定义

f = RANK((Factor('net_profit_parent_company_ttm_0')/Factor('equity_parent_company_ttm_0')) /(Factor('net_profit_parent_company_ttm_1')/Factor('equity_parent_company_ttm_1')), 'first', True)

d1 = '20210101'

d2 = '20211201'

ids= index_components('000300.XSHG',d1)

#因子数据

df = execute_factor(f,ids,d1,d2)

df = df.resample('BM').last()

#合成每个自然月的收益率数据

returns=get_price_change_rate(ids, start_date=d1, end_date=d2, expect_df=True)+1

#为了使用resample能更便捷聚合收益率数据,这里直接将收益率数据index平移一个交易日

returns.index=get_trading_dates(get_previous_trading_date(returns.index[0]), get_previous_trading_date(returns.index[-1]), market='cn')

returns.columns.name=''

returns.index=pd.DatetimeIndex(returns.index)

#returns.index平移后,聚合的为当月第二个交易日到下一个月第一个交易日的收益率数据

returns=returns.resample('BM').prod()-1

returns.index=pd.DatetimeIndex(returns.index.date)

returns.columns.name=''

# 构建管道,并将因子值和收益率传入分析器中进行计算

engine = FactorAnalysisEngine()

# engine.append(('winzorization-mad', Winzorization(method='mad')))

engine.append(('rank_ic_analysis', ICAnalysis(rank_ic=True, industry_classification='sws',max_decay=10)))

engine.append(('QuantileReturnAnalysis', QuantileReturnAnalysis(quantile=10, benchmark='000300.XSHG')))

result = engine.analysis(df, returns, ascending=True, periods=1, keep_preprocess_result=True)- 查看 IC 分析结果及分组情况

python

In[]:

result['rank_ic_analysis'].summary()

Out[]:

P_1

mean -0.006272

std 0.106604

positive 7.000000

negative 5.000000

significance 0.333333

sig_positive 0.083333

sig_negative 0.083333

t_stat -0.203807

p_value 0.842226

skew 0.281141

kurtosis 0.418097

ir -0.058834

In[]:

result['QuantileReturnAnalysis'].quantile_detail

Out[]:

order_book_id 600183.XSHG 603658.XSHG 601319.XSHG 600637.XSHG 002179.XSHE \

datetime

2021-01-29 NaN NaN NaN NaN NaN

2021-02-26 q5 q3 q4 q6 q7

2021-03-31 q5 q3 q4 q6 q7

2021-04-30 q3 q3 q4 q6 q6

2021-05-31 q7 q2 q8 q4 q9

2021-06-30 q7 q2 q8 q4 q9

2021-07-30 q7 q2 q8 q4 q9

2021-08-31 q7 q2 q8 q4 q9

2021-09-30 q9 q2 q7 q2 q3

2021-10-29 q9 q2 q7 q2 q3

2021-11-30 q9 q3 q2 q3 q6

2021-12-31 q9 q3 q2 q3 q6

order_book_id 002050.XSHE 600660.XSHG 600176.XSHG 601877.XSHG 000157.XSHE \

datetime

2021-01-29 NaN NaN NaN NaN NaN

2021-02-26 q6 q3 q4 q5 q7

2021-03-31 q6 q3 q4 q5 q7

2021-04-30 q4 q8 q9 q5 q7

2021-05-31 q7 q9 q10 q2 q8

2021-06-30 q7 q9 q10 q2 q8

2021-07-30 q7 q9 q10 q2 q8

2021-08-31 q7 q9 q10 q2 q8

2021-09-30 q5 q8 q10 q5 q2

2021-10-29 q5 q8 q10 q5 q2

2021-11-30 q5 q5 q10 q3 q2

2021-12-31 q5 q5 q10 q3 q2

order_book_id ... 002311.XSHE 601398.XSHG 601111.XSHG 002384.XSHE \

datetime ...

2021-01-29 ... NaN NaN NaN NaN

2021-02-26 ... q6 q4 q10 q1

2021-03-31 ... q6 q4 q10 q1

2021-04-30 ... q6 q7 q10 q1

2021-05-31 ... q7 q4 q9 q2

2021-06-30 ... q7 q4 q9 q2

2021-07-30 ... q7 q4 q9 q2

2021-08-31 ... q2 q4 q9 q2

2021-09-30 ... q3 q6 q1 q3

2021-10-29 ... q3 q6 q1 q3

2021-11-30 ... q1 q6 q10 q8

2021-12-31 ... q1 q6 q10 q8

order_book_id 002594.XSHE 600690.XSHG 002600.XSHE 000661.XSHE 600019.XSHG \

datetime

2021-01-29 NaN NaN NaN NaN NaN

2021-02-26 q10 q8 q1 q7 q8

2021-03-31 q10 q8 q1 q7 q8

2021-04-30 q9 q9 q10 q5 q8

2021-05-31 q2 q7 q8 q6 q10

2021-06-30 q2 q7 q8 q6 q10

2021-07-30 q2 q7 q8 q6 q10

2021-08-31 q2 q7 q8 q6 q10

2021-09-30 q1 q8 q1 q5 q10

2021-10-29 q1 q8 q1 q5 q10

2021-11-30 q1 q2 q6 q5 q9

2021-12-31 q1 q2 q6 q5 q9

order_book_id 002008.XSHE

datetime

2021-01-29 NaN

2021-02-26 q9

2021-03-31 q9

2021-04-30 q2

2021-05-31 q9

2021-06-30 q9

2021-07-30 q9

2021-08-31 q9

2021-09-30 q6

2021-10-29 q6

2021-11-30 q9

2021-12-31 q9

[12 rows x 300 columns]- 绘制 IC 分析结果

python

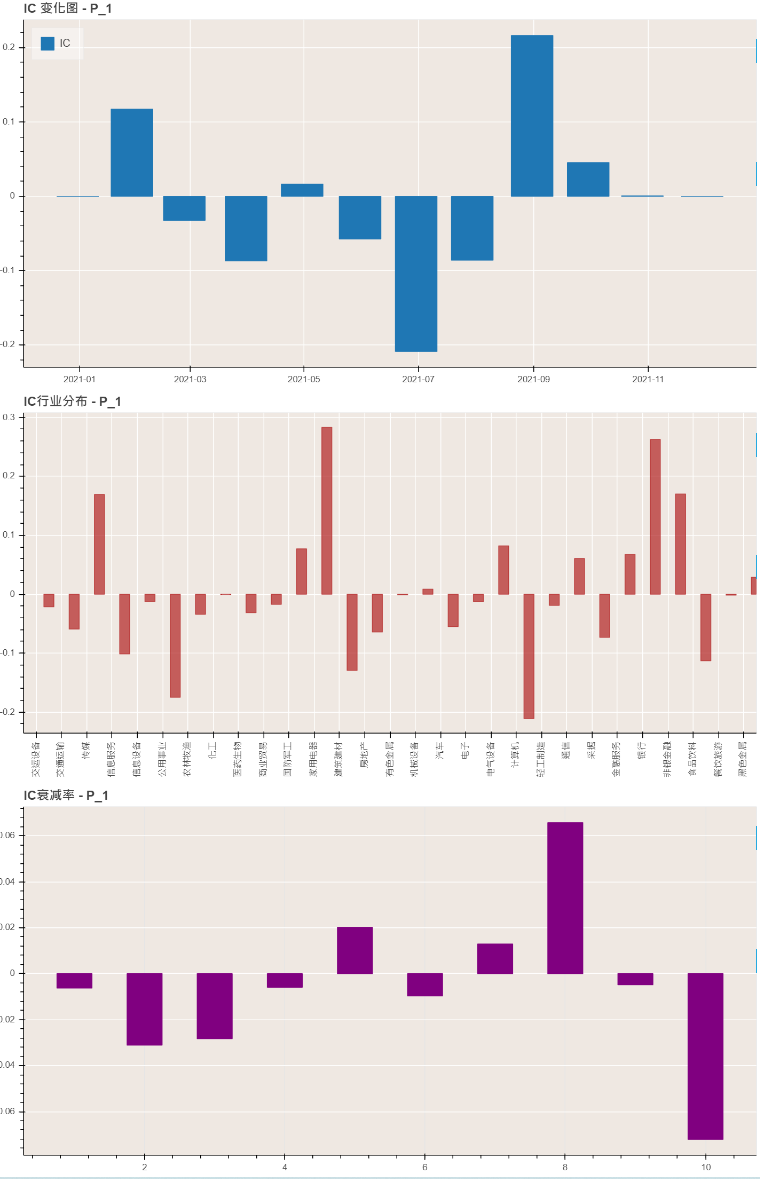

result['rank_ic_analysis'].show()

F-Score 因子范例

F-Score 因子出自 Piotroski 的论文《Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers》,主要从三个维度(profitability、financial leverage/liquidity、operating efficiency)来衡量公司的基本面状况。作者选用了九个好实施的指标,并且每个指标使用“好”或“坏”评判该公司在该指标上的表现。F-Score 因子是这九个指标的加总。

| 指标 | 打分方式 |

|---|---|

| 资产收益率 | 大于零为 1,否则为 0 |

| 资产收益率变化率 | 大于零为 1,否则为 0 |

| 经营活动产生的现金流比总资产 | 大于零为 1,否则为 0 |

| 应计收益率 | 大于零为 0,否则为 1 |

| 长期负债率变化 | 大于零为 0,否则为 1 |

| 流动比率变化 | 大于零为 0,否则为 1 |

| 股票是否增发 | 是为 0,否则为 1 |

| 毛利率变化 | 大于零为 1,否则为 0 |

| 资产周转率 | 大于零为 1,否则为 0 |

python

from rqfactor import *

from rqfactor.extension import *

from rqfactor.engine_v2 import *

import rqdatac as rq

import pandas as pd

rq.init()

import numpy as np

from rqfactor.engine_v2 import execute_factor

#自定义算子,使得因子值大于0时返回1,否则返回0

def fillter(df):

df[df>0]=1

df[df<=0]=0

df=df.fillna(0)

return df

def Fillter(f):

return UnaryCrossSectionalFactor(fillter, f)

#自定义算子,使得因子值大于0时返回0,否则返回1

def fillter_1(df):

df[df<0]=1

df[df>=0]=0

df=df.fillna(0)

return df

def Fillter_1(f):

return UnaryCrossSectionalFactor(fillter_1, f)

##构建因子

#1.ROA因子,大于0得1分,否则0分

f1 = Fillter(Factor('return_on_asset_ttm'))

#2.Δroa因子,大于0得1分,否则0分

f2 = Fillter(Factor('net_profit_mrq_0')/Factor('total_assets_mrq_0')-Factor('net_profit_mrq_3')/Factor('total_assets_mrq_3'))

#3.cfoa因子,大于0得1分,否则0分

f3 = Fillter(Factor('cash_flow_from_operating_activities_ttm_0')/Factor('total_assets_ttm_0'))

#4.应计利润,小于0得1分,否则0分

f4 = Fillter_1((Factor('profit_from_operation_ttm_0')-Factor('cash_flow_from_operating_activities_ttm_0'))/Factor('total_assets_ttm_0'))

#5.ΔLEVER,小于0得1分,否则0分,需对银行类别进行处理

def lever(order_book_ids, start_date, end_date):

trading_dates=rq.get_trading_dates(start_date, end_date, market='cn')

a=rq.get_factor(order_book_ids,'non_current_liabilities_mrq_0',start_date, end_date)['non_current_liabilities_mrq_0']

b=rq.get_factor(order_book_ids,'total_assets_mrq_0',start_date, end_date)['total_assets_mrq_0']

lever=a/b

lever=lever.unstack('order_book_id')

lever.columns.name=''

lever.index.name=''

lever=lever.reset_index(drop = False)

lever.index=lever[''].tolist()

lever.index=trading_dates

lever=lever.drop(columns='')

for key,value in lever.iteritems():

if key in rq.get_industry('银行', source='citics', date=end_date):

lever[key]=rq.get_factor(key,'deposits',start_date, end_date).unstack('order_book_id')['deposits']\

+rq.get_factor(key,'bond_payable',start_date, end_date).unstack('order_book_id')['bond_payable']\

+rq.get_factor(key,'borrowings_from_central_banks', start_date, end_date).unstack('order_book_id')['borrowings_from_central_banks']

lever.index = pd.DatetimeIndex(lever.index)

return lever

LEVER=UserDefinedLeafFactor('LEVER', lever)

f5=Fillter_1(LEVER-REF(LEVER, 252))

#6.ΔLIQUID,大于0得1分,否则0分

def liquid(order_book_ids, start_date, end_date):

trading_dates=rq.get_trading_dates(start_date, end_date, market='cn')

a=rq.get_factor(order_book_ids,'current_assets',start_date, end_date).fillna(method='pad')

b=rq.get_factor(order_book_ids,'current_liabilities',start_date, end_date).fillna(method='pad')

liquid=a['current_assets']/b['current_liabilities']

liquid=liquid.unstack('order_book_id')

liquid.columns.name=''

liquid.index.name=''

liquid=liquid.reset_index(drop = False)

liquid.index=liquid[''].tolist()

liquid.index=trading_dates

liquid=liquid.drop(columns='')

for key,value in liquid.iteritems():

bf_obi=rq.get_industry('银行', source='citics', date=end_date)+rq.get_industry('非银行金融', source='citics', date=end_date)

a=['cash_equivalent','deposits_of_interbank','precious_metals','lend_capital',

'financial_asset_held_for_trading','derivative_financial_assets','resale_financial_assets',

'interest_receivable','loans_advances_to_customers','financial_asset_available_for_sale'

'financial_asset_hold_to_maturity','loan_account_receivables']

b=['borrowings_from_central_banks','deposits_of_interbank','borrowings_capital','financial_liabilities',

'derivative_financial_liabilities','buy_back_security_proceeds','deposits','payroll_payable',

'tax_payable','dividend_payable']

if key in bf_obi:

liquid[key]=(rq.get_factor(key,a,start_date,end_date).sum(axis=1)/rq.get_factor(key,b,start_date,end_date).sum(axis=1)).unstack('order_book_id')

liquid.index=pd.DatetimeIndex(liquid.index)

return liquid

LIQUID=UserDefinedLeafFactor('LIQUID', liquid)

f6 = Fillter(LIQUID-REF(LIQUID,252))

#7.EQ_OFFER,过去一年是否增发或配售新股,没有增发得1分,否则为0

def eq_offer(order_book_ids, start_date, end_date):

trading_dates=rq.get_trading_dates(start_date, end_date, market='cn')

c=pd.DataFrame(columns=order_book_ids,index=trading_dates)

for i in trading_dates:

pp=rq.get_private_placement(order_book_ids, start_date=rq.get_previous_trading_date(i,252,market='cn'),

end_date=i, progress='complete',issue_type='private', market='cn')

for b in pp.index.get_level_values('order_book_id').values:

c.loc[i, b] = 0

for i in trading_dates:

pp=rq.get_private_placement(order_book_ids, start_date=rq.get_previous_trading_date(i,252,market='cn'),

end_date=i, progress='complete',issue_type='private', market='cn')

for b in pp.index.get_level_values('order_book_id').values:

c.loc[i, b] = 0

c=c.fillna(1)

c.index = pd.DatetimeIndex(c.index)

return c

f7 = UserDefinedLeafFactor('EQ_OFFER', eq_offer) #自定义因子

#8.ΔMARGIN因子,大于0得1分,否则0分

f8 = Fillter((Factor('operating_revenue_mrq_0')-Factor('total_expense_mrq_0'))/Factor('operating_revenue_mrq_0')\

-(Factor('operating_revenue_mrq_3')-Factor('total_expense_mrq_3'))/Factor('operating_revenue_mrq_3'))

#9.ΔTURN:最新报告期资产周转率-上年同期资产周转率,大于0得1分,否则0分

f9 =Fillter(Factor('operating_revenue_mrq_0') / Factor('total_assets_mrq_0')-Factor('operating_revenue_mrq_3') / Factor('total_assets_mrq_3'))

f=f1+f2+f3+f4+f5+f6+f7+f8+f9

#检验因子

#print(execute_factor(f, rq.index_components('000300.XSHG', '20180201'), '20180101', '20180201'))

df=execute_factor(f, rq.index_components('000300.XSHG','20150101'), '20150101', '20200101')

engine = FactorAnalysisEngine()

engine.append(('neutralization',Neutralization(industry='sws',style_factors=['size','beta','momentum','growth','book_to_price','residual_volatility','non_linear_size'])))

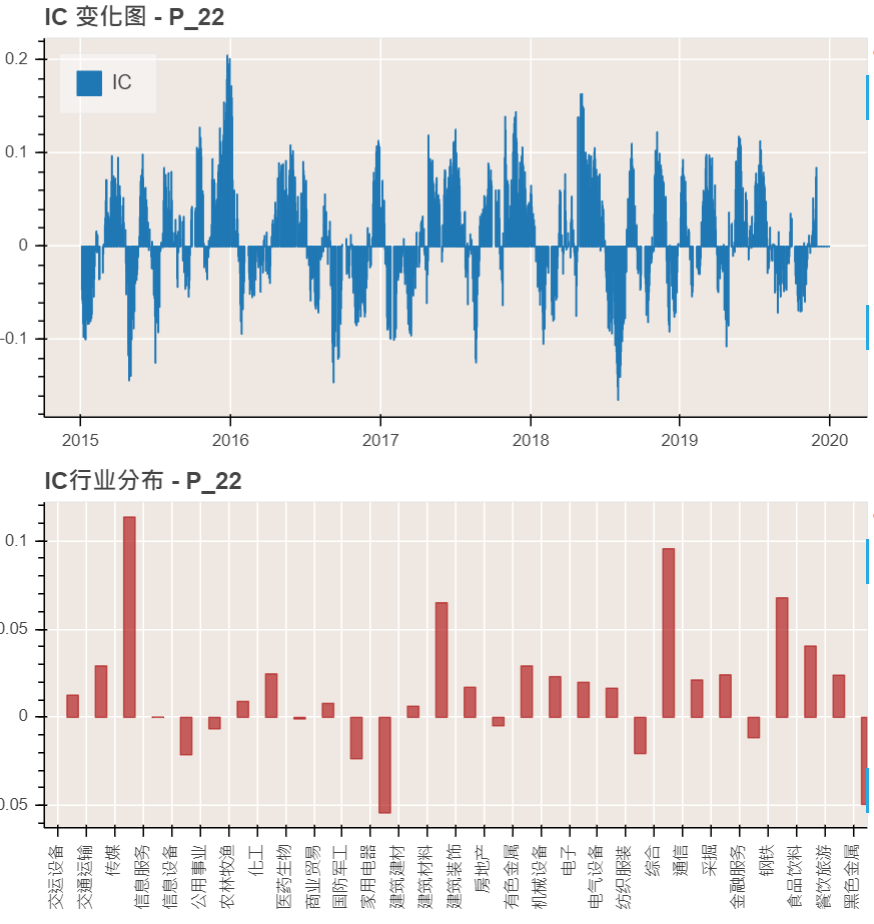

engine.append(('rank_ic_analysis', ICAnalysis(rank_ic=False, industry_classification='sws')))

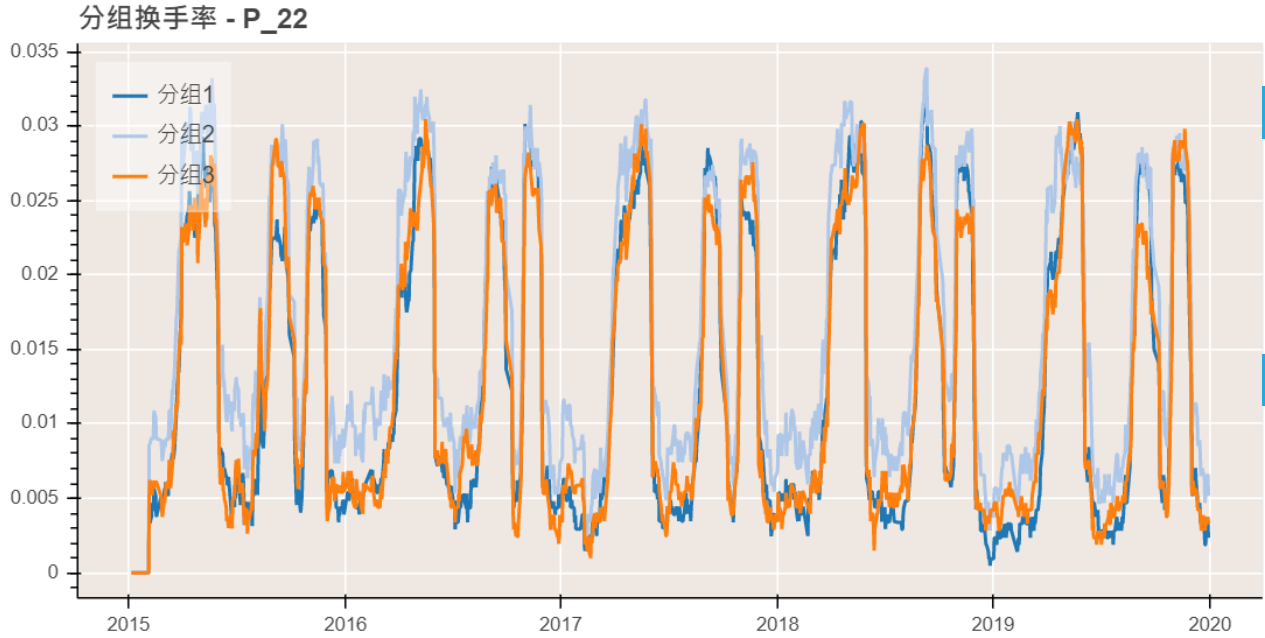

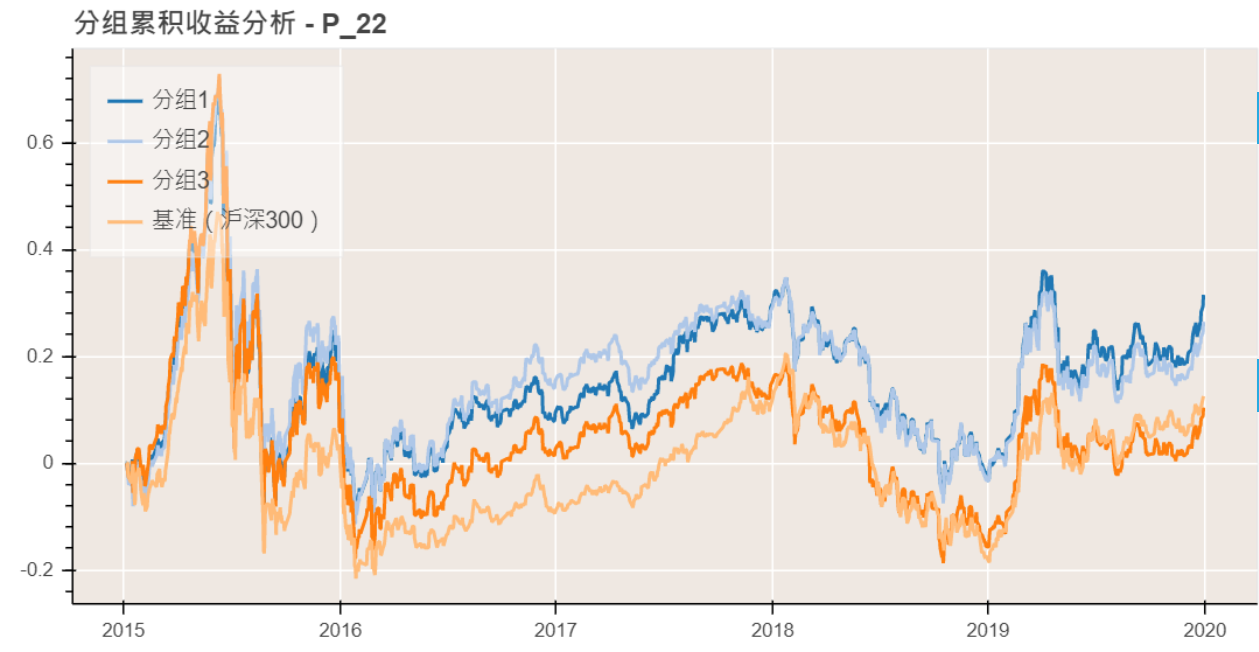

engine.append(('QuantileReturnAnalysis', QuantileReturnAnalysis(quantile=3, benchmark='000300.XSHG')))

result = engine.analysis(df, 'daily', ascending=False, periods=22, keep_preprocess_result=True)

# 绘制 IC 结果图

result['rank_ic_analysis'].show()

result['QuantileReturnAnalysis'].show()